- Solutions

- Partners

- Resources

- Blog

- GovCon Source

- GovCon Source Home

- Lean & Agile in the Age of DOGE

- Service Contract Act (SCA)

- DCAA Compliant Accounting

- GovCon Outsourcing & Managed Services

- Government ERP Systems

- Veteran-Owned Small Businesses

- GovCon CyberSecurity

- Graduating 8(a) Program

- SBIRs & Grants

- GovCon Growth Strategies

- GovCon Compliance Audits

- Webinars

- DCAA Compliance

- GovCon Accounting

- Graduating 8(a) Program

- Service Contract Act (SCA)

- GovCon Managed Services

- Government ERP Systems

- GovCon Reviews & Audits

- Cybersecurity Compliance

- Government Grants & Contracts

- Company

Managing Government Grants and Contracts – (FAQ)

Understand the regulatory and compliance requirements you need to be aware of when managing SCA grants and contracts.

Profitably managing government grants and contracts is challenging! Government contracts contain many terms, conditions and requirements that must be followed by contractors, if they are going to be managed profitably. Contractors must track a steady flow of contract modifications that must be managed properly to handle the government funding correctly, including generating accurate and timely invoices. In this blog, we discuss the processes and systems that are required to manage grants and contracts, including cost accounting, timekeeping, expense tracking, contract, and project management to handle financial and project reporting.

AtWork Supports Your Complete Contract Lifecycle

Our system integrates contract management, project cost accounting and an automated billing system.

Find out how fast you can take your operations to the next level.

A government contractor's accounting system must track all the organization's costs and allow the costs to be separated by what is allowable (direct and indirect), and what is unallowable. Each grant or contract must be allocated a portion of the indirect costs. The unallowable cost cannot be charged to any government grant or contract. The accounting system must also help contractors demonstrate that their indirect cost allocation methodology is fair and equitable and can withstand the scrutiny of a government audit. Determining whether a contract or project is profitable requires tracking fully burdened costs - managing direct and applying indirect cost.

A government contractor's contract and project management system must provide detailed job cost reports that track the details needed to determine profit and loss. As we outline in this blog, this requires implementing systems that support the entire contract and project lifecycle including contract administration, project estimating, planning, executing (operating), and reporting. Supporting all these functions requires putting in place a DCAA compliant ERP system that allows contractors to not only manage all the required information, but can also monitor profitability and provide early warning when things are starting to go off course.

And finally, a government contractor's billing system must provide the ability to generate accurate and timely invoices with appropriate supporting details based on the contract type that was awarded. Accurate billing also requires putting in place a timekeeping and expense tracking system.

DCAA compliant ERP systems, such as AtWork Systems', OneLynk platform includes integrated accounting, timekeeping, expense reporting, contract and project management for all the functions needed by contractors to profitably manage grants and contracts. OneLynk is built using a mobile first strategy to allow organizations to operate 24/7 from anywhere. Security is based on role-based access that allows access to be restricted based on user functions, organizational responsibility, and role. OneLynk also utilizes end-2-end workflow and document management to allow processes to be automated and streamlined. The net result is improved internal controls and compliance. Integrated cost accounting, timekeeping, expense tracking and contract and project management provide the features needed to track and manage contract technical and financial performance.

What type of contracts are used by the government when purchasing supplies and services?

There are four primary types of government contracts, and the difference between them can be significant. Each requires a unique approach to bidding, and a unique approach to performing the work, as well as what you'll need to track to be profitable. Understanding the distinct challenges and opportunities of each contract is important for every business in selling to the government if that business is to succeed as a government contractor. When selecting a contract type, each government agency examines its requirements, analyzes its financial and performance risks, and develops an acquisition strategy that determines the appropriate contract type to meet the government's needs. Contract types fall into four main categories:

- Fixed price

- Cost-reimbursable

- Time and material

- Infinite delivery/indefinite quantity (IDIQ)

Learn More: Major Government Contract Types - What You Need to Know

What key metrics should be tracked to determine the profit/loss of a government contract?

The table below provides overall guidance on what you'll need to track to successfully manage each contract type. The bottom line is, regardless of the contract type, you must always keep tabs on your profit/loss, the planned vs. actual costs, and any contract ceilings, including labor, expense, travel, or materials. Your organization must implement the processes and systems to do this well.

In the table below we summarize the key profit/loss (P/L) metrics for each contract type. We present what variables are most relevant, and how to use them to monitor the most pertinent metrics. In addition to P/L, tracking planned vs. actual cost is critically important, as well as how this impacts the overall progress toward completing the work plan.

For those who have project management experience much of this will be familiar, however, there are a few details that can trip you up when executing government contracts if not handled correctly - its all about managing risks.

How will you track these key metrics? There are important approaches and tools you need to have in your toolkit. Really, in today's world, you'll need software such as an accounting system, timekeeping and expense management, contract management, and project management systems to help you to track these key metrics. These tools will help you to not just plan the plan, but execute it profitably.

| Contract Types | Project Status Tracking | Key Metrics | Mitigation Strategy |

|---|---|---|---|

| Below is a description of how the status tracking needs to be adjusted when executing the project based on different contract types | Below are the key metrics that should be tracked during the execution of the project based on different contract types |

|

|

| All Types | Track planned vs actual cost for each task and overall project

|

|

|

| Labor Hour | Track hours worked for each labor category for each task.

|

|

|

| Time & Material | Track hours worked for each labor category, expenses, and materials for each task.

|

|

|

| Cost Reimbursable | Track hours worked for each labor category, expenses, and materials for each task.

|

|

|

| Fixed Price | Track hours worked by person, expenses, and materials for each task.

|

|

|

| Note: Fully Burdened Rate is a factor that allows for the full recovery of all the firms indirect cost | |||

Key Metrics for Labor Hour and T&M Contracts - The key metrics that need to be tracked when managing labor hour and time & material contracts are very similar. Notice the mitigation strategies for those involve adequate timekeeping systems. When we look at the project status tracking column, both labor hour and time & material involve tracking hours worked, as well expenses and materials, respectively. The key metrics are hours remaining and budget remaining. Those variables and metrics help us enable the mitigation strategies for those types of contracts.

You'll notice the labor hour row in the table mentions calculating "ACTUAL COST." What is that? Actual cost is another term for "fully burdened cost using actual indirect rates." It's a number that incorporates the direct cost, as well as other the project's portion of the indirect cost incurred. The fully burdened cost is calculated by applying the actual indirect rates. For example, paying an employee a salary is a direct cost. We all know, however, that it costs more to employ an employee than just his salary. We pay for benefits like insurance and retirement, but we also pay for things we're used to indirectly to support the employee like rent, software, and utilities. These are indirect costs that the accounting system is tracking, and the government has a system for reimbursing you for those costs.

Actual indirect rates are usually calculated by the accounting system monthly, and they need to be used to compute your real project cost.

Key Metrics for Cost Reimbursable Contracts - Cost Reimbursable contracts require quite a bit of tracking and more complex data. (Remember the 100% certainty of audit for a cost reimbursable contract?) We need to track all our labor, material costs as well as expenses, each cost must be fully burdened. A fully burdened rate incorporates all the indirect costs of doing business, such as employee benefits, rent, accounting services, software, etc. In a cost reimbursable contract, all labor, expense, and material costs must be fully burdened to have an accurate estimate of the cost of providing the product or service you've promised.

Key Metrics for Firm Fixed Price Contracts - For a Fixed Price contract, mitigation strategies are to know the customer, scope of work, how those align with your business capabilities, and being sure requirements are well defined. When the requirements are well defined, keeping track of progress toward meeting them is a clearer process, as required by the key metric there, comparing percentage of work complete to percentage of budget spent. This information is also critical to providing accurate estimates of what a project will cost to complete at any stage.

What are the advantages of integrated contract lifecycle management software?

Contract lifecycle management tools are required to support the administration of a government contract after award. The contract management system must track all the data needed to generate accurate and timely status reports and invoices. In a related blog, <<link to blog ... Automated Billing Systems >> we describe the what's required to setup and track government contracts. The accounting and billing system must handle the funding and billing correctly and comply with government reporting requirements. A government contractor's project management system must provide detailed job cost reports while supporting the entire project lifecycle including estimating, planning, executing (operating), and reporting.

During the contract lifecycle the government may issue many modifications that must be reviewed, and the contract data may need to be updated to support accurate reporting and billing. An integrated system allows contract documents to be uploaded and associated directly with the contract. Role-based access should allow file access to be restricted.

Many government contractors implement standalone tools for contract management, accounting, and billing. The problem with standalone systems is they were designed for very specific functions and therefore lack the integrated features to support the entire lifecycle. Standalone systems force contractors to put in place manual processes supported by spreadsheets. These spreadsheets may track important contract information such as funding, billing totals etc., but don't provide a complete view because they don't track the key profit/loss metrics. And they introduce costly and inefficient manual processes. The benefits of integrated contract lifecycle management software are that they provide the accounting, contract administration and billing data needed to eliminate manual processes.

What are the advantages of integrated accounting and project management software?

Managing government grants, contracts and projects requires cost accounting and project management systems to handle the funding correctly and to comply with government reporting requirements. A government contractor's accounting system must track all the organization's costs and allow the costs to be separated by what is allowable (direct and indirect), and what is unallowable. Each grant, contract, or project must be allocated a portion of the indirect costs. The unallowable cost cannot be charged to any government grant or contract. The accounting system must help contractors demonstrate that their indirect cost allocation methodology is fair and equitable and can withstand the scrutiny of a government audit.

A government contractor's project management system must provide detailed job cost reports while supporting the entire project lifecycle including estimating, planning, executing (operating), and reporting. Supporting all these functions requires putting in place project cost accounting software.

Many government contractors have implemented standalone tools for accounting and project management. The problem with standalone PM tools such as Microsoft Project or Monday from Ansonia is they were designed for project planning but lack the project cost accounting features to support the entire lifecycle. They don't support the ability to view project cost data in real-time which includes allocated indirect costs. This is essential for understanding the total cost of a grant or contract and for making decisions. Standalone accounting software, such as QuickBooks, allows accountants to record and track project direct costs but does not have the ability to provide the project team with timely job cost reports containing the allocated indirect cost, forcing them to put in place manual processes supported by spreadsheets. These spreadsheets may track important project information such as labor, expenses, and material charges but don't provide a complete view because they don't show the fully burdened cost and they introduce costly and inefficient manual processes. In the blog <<Link to blog ... Advantages of Integrated Project Accounting Software for Managing Government Grants and Contracts>>, we describe why accounting and project functions need to be tightly integrated. And we describe the benefits of integrated project cost accounting software. Finally, we provide an overview of AtWork Systems integrated project cost accounting system, OneLynk, which supports the ability to track fully burdened job costs using bid, target, actual, and forecast indirect rates.

Learn More: Advantages of Integrated Project Accounting Software for Managing Government Grants and Contracts

What are the requirements for a contract lifecycle management solution?

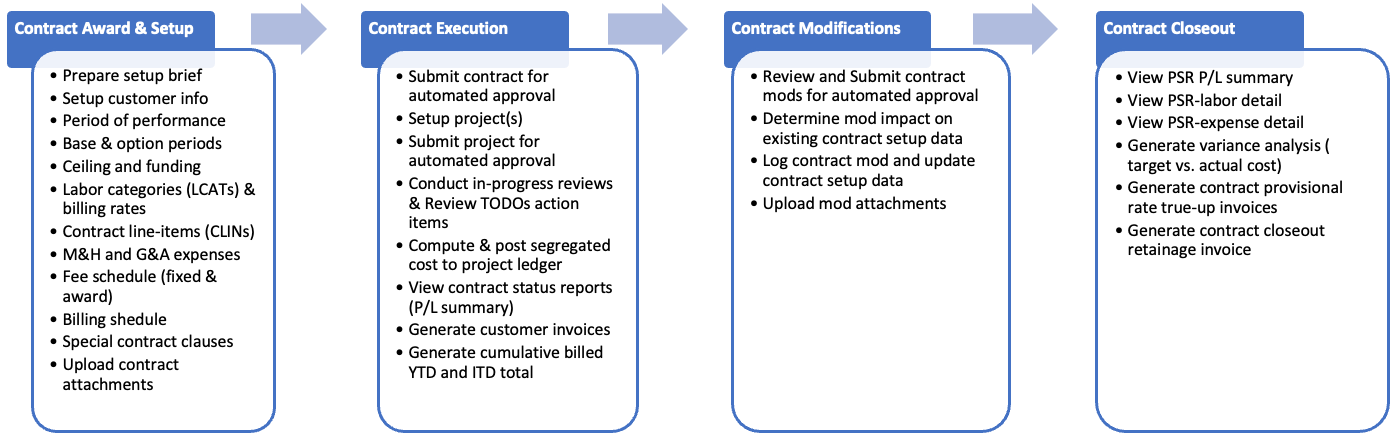

An integrated contract lifecycle management system should provide end-2-end processes to manage the entire contract lifecycle. As illustrated in the diagram below, an integrated system supports every aspect of the lifecycle from contract award to closeout.

An integrated contract lifecycle management system should include tools for automating the tracking of the contract master data required to accurately generate contract cost reports, as well as the generation of customer invoices. An integrated system should help you track your actual contract costs and post the cost to the project and general ledger needed to generate the customer invoices and financial reports. At a high level to manage the entire contract lifecycle the system should support:

- Reviewing contract functional, technical, and cost requirements.

- Preparing contract setup brief for the contract admin team.

- Entering contract master data including PoP, options, ceiling & fundings, CLINs, & billing plan.

- Submitting contract master data for approval, review, and revise as necessary.

- After approval, setup necessary projects and submit projects for approval.

- Submitting, approve and process timesheets, expense reports & vendor invoices.

- Computing fully burdened costs and update the project ledger and general ledger (GL).

- Generating customer invoices and prepare supporting invoice documents.

- Generating contract job cost status reports as required.

- Generating financial reports using processed contract data in the GL.

- Upon completion or if terminated, close out the contract.

- Generating true-up and retainage invoices

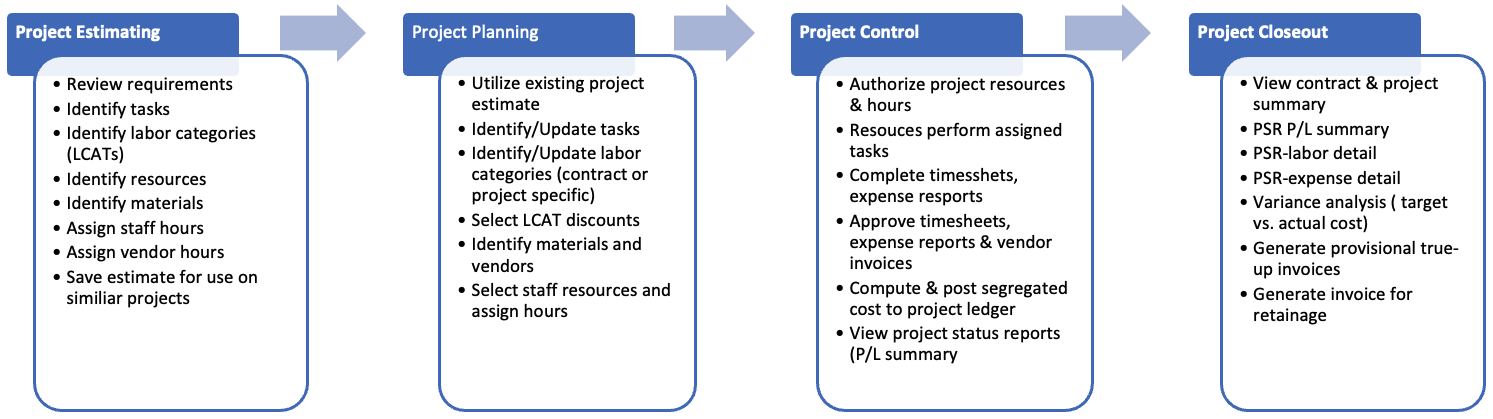

What are the requirements for a project estimating, planning and control solution?

An integrated project management and accounting system should provide end-2-end processes to manage the entire project lifecycle. As illustrated in the diagram below, an integrated system supports every aspect of the project lifecycle from estimating to closeout. An integrated project system also supports the ability to build reusable work breakdown structures (WBS) that include all the tasks needed to ensure that your project teams deliver what was promised. This includes providing accurate and timely job cost reports containing the fully burdened cost and creating a library of reusable project estimates that can be used to plan, execute, and closeout projects.

An integrated project accounting system provides the tools for automating the creation of the project plan including establishing tasks and budgets as well as automating the tracking you'll need to collect and review job costs. Once your project plan has been developed, you'll have a good baseline for the planned cost. An integrated system should help you track your actual project costs and provide reports to help you stay on track. At a high level to manage the entire project lifecycle you should:

- Review contract/project functional, technical, and cost requirements.

- Identify the major tasks, subtasks, and milestones that need to be performed.

- Identify subcontractors needed to address capabilities gaps.

- Provide a staffing plan and budget for the labor required.

- Provide a budget for the materials and expenses required.

- Develop a detailed project schedule showing key deliverables.

- Submit a project plan for approval, review, and revise as necessary.

- After approval, authorize resources (employees, consultants & vendors).

- Submit and process timesheets, expense reports & vendor invoices.

- Compute fully burdened costs and update the project ledger and general ledger (GL).

- Generate customer invoices and prepare supporting documents.

- Generate project job cost status reports as required.

- Generate financial reports using processed project data.

- Upon completion or if terminated, close out the contract or project.

What are the requirements for billing government grants and contracts?

Successfully managing government grants and contracts requires you to do many tasks well! Billing your customers timely and accurately should be at the top of the list. However, we often see our clients struggling to do this. Many have implemented billing systems that rely on offline processes that introduce errors and can significantly impact cash flow. The billing function is the major indicator as to whether you have a complete and properly designed GovCon ERP system. If you do, you will be able to bill your government customer easily and accurately for your supplies and services regardless of the contract type or billing requirements. If you do not, you will be going offline to manually prepare your invoices and supporting detail which drives up your indirect costs, increases your chances for errors and even worse, submitting erroneous invoices. There are many requirements to consider when automating the billing process for grants and contracts. Doing this requires an integrated contract lifecycle management, project cost accounting and billing system to be used to automate the entire billing process.

Learn More About AtWork Systems

AtWork Systems is an Arlington, Virginia based software development company. Its principals have decades of experience doing business with and working for federal, state, and local government. They developed OneLynk as a configurable and scalable business operating platform that digitizes and optimizes processes while providing just in time business intelligence for decision making. OneLynk contains a suite of easily configurable web applications for automating and monitoring business transactions, including: human capital management, finance, timekeeping and expense management, procurement, contracts and project management, payroll services and more. Check it out at www.AtWorkSys.com and see for yourself!

Ready for the Next Step?

Find out if AtWork’s integrated software suite and helpful team of GovCon experts can assist you. With more than a century of combined experience in government contracting, our team wants to hear from you.