- Solutions

- Partners

- Resources

- Blog

- GovCon Source

- GovCon Source Home

- Lean & Agile in the Age of DOGE

- Service Contract Act (SCA)

- DCAA Compliant Accounting

- GovCon Outsourcing & Managed Services

- Government ERP Systems

- Veteran-Owned Small Businesses

- GovCon CyberSecurity

- Graduating 8(a) Program

- SBIRs & Grants

- GovCon Growth Strategies

- GovCon Compliance Audits

- Webinars

- DCAA Compliance

- GovCon Accounting

- Graduating 8(a) Program

- Service Contract Act (SCA)

- GovCon Managed Services

- Government ERP Systems

- GovCon Reviews & Audits

- Cybersecurity Compliance

- Government Grants & Contracts

- Company

February 28, 2023

Advantages of Integrated Project Cost Accounting Software for GovCons

Written by: Ron Lewis

Page Summary

Page Summary

Integrated project accounting and management systems streamline government grant and contract management by automating cost tracking, allocation, and reporting, eliminating manual processes, and providing real-time project cost insights for improved decision-making and compliance.

Integrated Accounting and Project Functions

Managing government grants, contracts and projects requires a robust set of processes and systems, including project management and accounting tools to handle the funding correctly and to comply with government reporting requirements. A government contractor's accounting system must track all the organization's costs and allow the costs to be separated by what is allowable (direct and indirect), and what is unallowable. Each grant, contract, or project must be allocated a portion of the indirect costs. The unallowable cost cannot be charged to any government grant or contract. The accounting system must help contractors demonstrate that their indirect cost allocation methodology is fair and equitable and can withstand the scrutiny of a government audit. A government contractor's project management system must provide detailed job cost reports while supporting the entire project lifecycle including estimating, planning, executing (operating), and reporting. Supporting all these functions requires putting in place project cost accounting software.

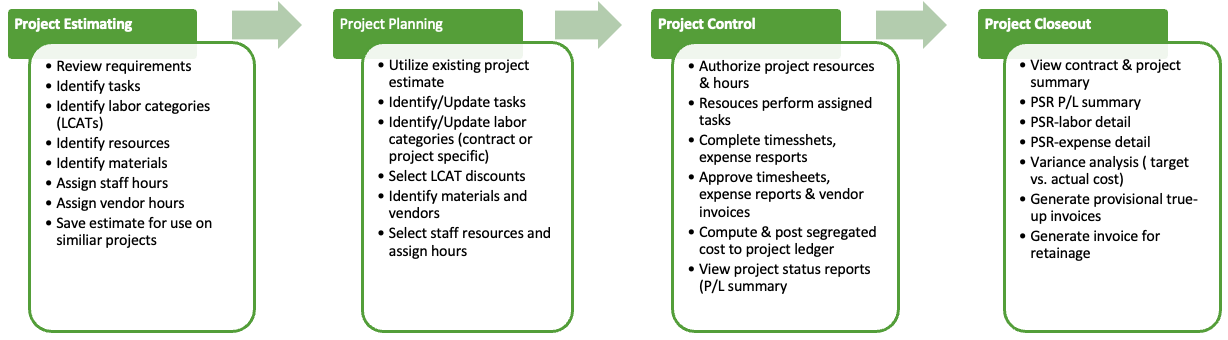

OneLynk™ Supports Your Complete Project Lifecycle

Powered by a DCAA compliant ERP system that supports the entire PM lifecycle including

project estimating, project planning, project control and project closeout.

project estimating, project planning, project control and project closeout.

Many government contractors have implemented standalone tools for accounting and project management. The problem with standalone PM tools such as Microsoft Project or Monday from Ansonia is they were designed for project planning but lack the project cost accounting features to support the entire lifecycle. They don't support the ability to view project cost data in real-time which includes allocated indirect costs. This is essential for understanding the total cost of a grant or contract and for making decisions. Standalone accounting software, such as QuickBooks, allows accountants to record and track project direct costs but does not have the ability to provide the project team with timely job cost reports containing the allocated indirect cost, forcing them to put in place manual processes supported by spreadsheets. These spreadsheets may track important project information such as labor, expenses, and material charges but don't provide a complete view because they don't show the fully burdened cost and they introduce costly and inefficient manual processes. In this blog, we describe why accounting and project functions need to be tightly integrated. And we describe the benefits of integrated project cost accounting software. Finally, we provide an overview of AtWork Systems integrated project cost accounting system, OneLynk, which supports the ability to track fully burdened job costs using bid, target, actual, and forecast indirect rates.

Project Management Lifecycle

An integrated project management and accounting system should provide end-2-end processes to manage the entire project lifecycle. As illustrated in the diagram below, an integrated system must support every aspect of the project lifecycle from estimating to closeout. The objective of this blog is to describe the advantages of implementing an integrated project cost accounting system and to provide a few "tips and techniques" to best leverage the system. We'll describe the benefits of utilizing an estimating tool to build a library of reusable project estimates that can be used to plan, execute, and close out contracts and projects. We'll describe how an integrated system can support the ability to build reusable work breakdown structures (WBS) that include all the tasks needed to ensure that your organization delivers what was promised, over and over. An integrated accounting system can provide accurate and timely job cost reports containing the fully burdened cost.

An integrated project accounting system provides the tools for automating the creation of the project plan including establishing tasks and budgets as well as automating the tracking you'll need to collect and review job costs. Once your project plan has been developed, you will have a good baseline for identifying your planned cost. An integrated system should help you track your actual project costs and provide reports to help you stay on track. At a high level to manage the entire project lifecycle, you should:

- Review contract/project functional, technical, and cost requirements.

- Identify the major tasks, subtasks, and milestones that need to be performed.

- Identify subcontractors needed to address capabilities gaps.

- Provide a staffing plan and budget for the labor required.

- Provide a budget for the materials and expenses required.

- Develop a detailed project schedule showing key deliverables.

- Submit a project plan for approval, review, and revise as necessary.

- After approval, authorize resources (employees, consultants & vendors).

- Submit and process timesheets, expense reports & vendor invoices.

- Compute fully burdened costs and update the project ledger and general ledger (GL).

- Generate customer invoices and prepare supporting documents.

- Generate project job cost status reports as required.

- Generate financial reports using processed project data.

- Upon completion or if terminated, close out the contract or project.

If this seems like a lot, here's a bit of good news, you're probably already doing this and all the accounting and project management techniques you have mastered over the years are still valid. You are probably doing many of these steps today using manual processes and spreadsheets. Integrated project accounting systems provide automated processes that will make your job a lot easier. To meet the job cost reporting requirements for government grants and contracts there are some new tasks you'll have to do. You need to be able to track and manage both your direct project costs as well as track and allocate your indirect cost. You must produce job cost reports with fully burdened costs. How well you manage your cost determines whether your contracts/projects will be profitable. Don't worry if this is not clear now, it will be by the time you complete this blog.

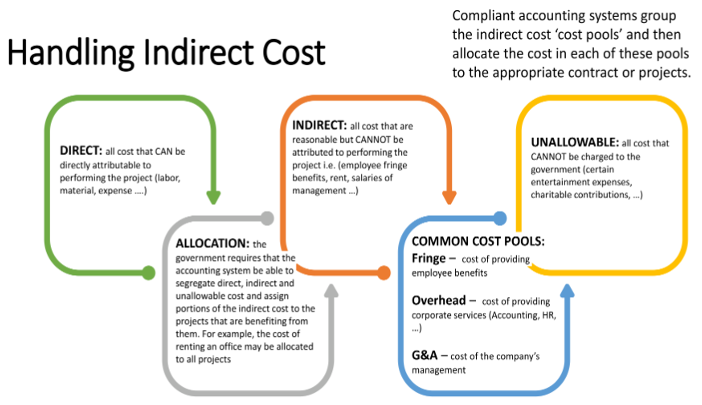

Direct, Indirect, and Unallowable Cost

To support government grant and contract requirements the accounting system chart of accounts (COA) should be structured to separate costs into two big categories: allowable (direct and indirect), and unallowable. Exactly how the COA gets structured will be up to the company's accounting team. Accounting systems designed for government contracting, such as AtWork Systems', OneLynk, provides pre-configured rate models to record direct cost using the cost of goods sold (COGS) account types. Indirect costs are recorded in operational expense (OPEX) account types. All unallowable costs are recorded in unallowable account types. In addition, OneLynk allows the accounting team to configure the project accounting system to record costs based on a set of generally accepted accounting practices (GAAP) that are compliant with the defense compliance audit agency (DCAA) guidelines defined in the SF-1408 pre-award survey. In addition, an integrated project accounting system ensures that as transactions, such as timesheets, expense reports, and vendor invoices are processed, they get posted to the correct GL accounts. Let's go over definitions for each account types we just introduced:

- Direct: includes all costs that CAN be directly attributable to performing the project, e.g., labor, material, travel, and training expenses.

- Indirect: includes all costs that are reasonable but CANNOT be attributed to performing the project e.g., employee fringe benefits, rent, and utilities.

- Unallowable: all costs that CANNOT be charged to the government, such as certain entertainment expenses like alcohol, and charitable contributions.

Allocation Base: The government requires you to implement a reasonable system that assigns a portion of the indirect cost to the projects that are benefiting from them. For example, the cost of renting an office may be allocated to all projects. Your accountant will develop an allocation base and use it to assign the cost to each project. Typically, the government will review and approve how you plan to allocate your indirect cost.

Common Cost Pools: All projects must pay for these costs via an indirect cost recovery rate. Your indirect cost recovery rate methodology is what you believe to be the fairest and most equitable way to proportionally charge indirect costs to all your customers on an ongoing basis. The accounting systems typically group the indirect cost into buckets called cost pools. The cost pool makes up the numerator (A) and the allocation base makes up the denominator (B) when determining the indirect cost recovery rate. The rate is calculated by dividing A by B. This allows the cost in each of these pools to be allocated appropriately to each project. Here are a few common pools:

- Fringe - the cost of providing employee benefits

- Overhead - the cost of providing corporate services (Accounting, HR, …)

- G&A - the cost of the company's management

In addition to the common cost pools, your accounting team may have set up a few more cost pools, your company may have staff working at the client's site or facilities that are used to only support specific contracts, or a procurement department supporting specific contracts. If any of these scenarios exists, then the indirect cost associated with supporting these contracts cannot be allocated to all the contracts. The pools described below are used to handle these scenarios:

- Overhead Client Site - the cost of providing corporate services to staff who work at the client site.

- Facilities - the cost of specialized facilities needed to support the execution of a contract or project.

- Subcontractor M&H - includes all indirect costs associated with purchasing materials for contracts.

Understanding Fully Burdened Cost

To illustrate how the cost recovery rate gets applied let's examine labor costs. When your employees complete their timesheets, they are recording their time spent working on each grant or contract. They use a charge code to record their time spent on each activity. When the timesheet period ends, the timesheets are processed, and a labor distribution report is produced. The labor distribution provides a summary of all the hours as well as the labor cost for each employee. This information is used to update the project ledger (PL) that is used to produce job cost reports. The labor distribution is also used to create journal entries (labor and fringe benefit entry) used to record the cost of the labor in the general ledger (GL).

The same process is used to record transactions involving expenses and material purchased. Using the information contained in the charge code, the project accounting system can assign the cost to the correct GL account.

Provisional/Target indirect rates are used when building the project plan cost buildups. When bidding on cost-type contracts, you'll need to submit supporting documentation showing how these rates were calculated. Otherwise, if you don't have approved provisional billing rates, you are allowed to adjust the indirect rates you use when bidding based on your view of how your rates might change over time.

Understanding Burdened Costs

| Jim Garrett - Instructional Systems Designer | Annual Salary: $100,000 | |||

|---|---|---|---|---|

| Indirect Rates: Fringe Rate = 32% Overhead Rate = 25% G&A Rate = 12% Fee = 10% | ||||

| Cost Category | Segregated Cost Calculation | Target | Actual | Variance |

| Direct Labor (DL) | = Annual Salary / 2080 | $ 48.08 | $ 48.08 | $ 0.00 |

| Fringe | = DL * Fringe Rate | $ 15.38 | $ 19.23 | $ (3.84) |

| Overhead | = (DL + Fringe) * Overhead Rate | $ 15.97 | $ 21.54 | $ (5.67) |

| G&A | = (DL + Fringe + Overhead) * G&A Rate | $ 9.52 | $ 13.33 | $ (3.81) |

| Fee | = (DL + Fringe + Overhead+ G&A) * Fee | $ 8.88 | $ 10.22 | $ (1.33) |

| Fully Burdened | = (DL + Fringe + Overhead + G&A + Fee) | $ 97.73 | $ 112.39 | $ (14.66) |

| Billing Rate | $ 97.73 | $ 112.00 | $ (14.66) | |

The table above provides an example of how to calculate the direct cost, segregated cost, and fee. The total represents the fully burdened costs, consisting of direct costs with all the indirect rates applied. In this example, we've provided typical fringe, overhead, and G&A indirect rates. For an example involving expenses, only G&A and M&H would be applied, if those markups were allowed by the contract. Your indirect rates must be calculated using your accounting system using the actual cost incurred. If you are bidding on a cost-reimbursable contract, your company will be required to submit supporting justification to the government with its cost proposal to show how these rates were determined. These are called your provisional/target indirect rates and must be approved by the government. An integrated project accounting system uses the approved provisional/target rates to calculate the fully burdened cost. Provisional/target rates are also used in generating the customer invoice for cost-reimbursable contracts.

OneLynk's Integrated Accounting and PM System

OneLynk's integrated project accounting system manages the details of computing indirect rates and calculating the fully burdened project costs. Fully burdened cost is computed using four different indirect rate scenarios:

- bid - user-defined contract-specific indirect rates used when bidding on a specific contract. These rates are typically lower than the target rates. As they, allow the organization to submit a more competitive price.

- target - indirect rates are calculated using the target account balances established through an annual budgeting process. These rates are used to establish provisional rates approved by the government (DCAA or ACO) and provided a way for organizations to measure their cost control performance against actuals.

- actual - indirect rates are calculated using the actual account balances. During each accounting cycle, the system processes all approved transactions and updates the rates based on the actual account balances.

- forecast - user-defined indirect rates based on updating the forecast account balances. Forecast account balances can be updated at any time. Updated forecast balances allow the project and accounting team to view job costs based on a more accurate view of how the company has managed its forecasted total costs.

When transactions, such as timesheets, expense reports, and vendor invoices are approved, the indirect rates are applied to compute the segregated cost. The segregated cost data consisting of the direct labor, fringe, overhead, G&A, and any applicable M&H cost is stored in Project Ledger (PL). The integrated project accounting system uses the PL data to provide project status reports (PSRs) using bid, target, actual, and forecast indirect rates. These reports allow you to conduct variance analysis to ensure that your planned cost and actual cost are in sync. If they are not, a corrective action plan must be put in place to address cost overruns.

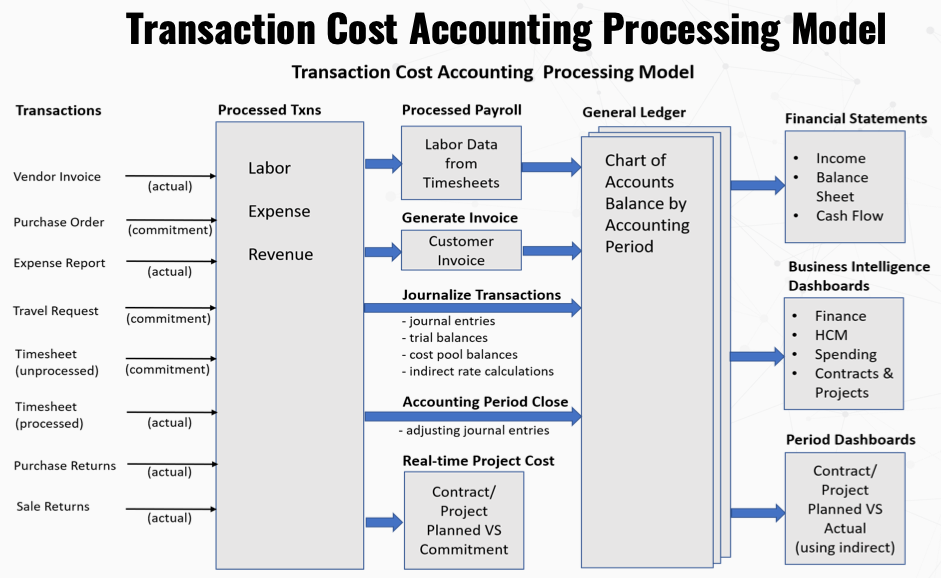

OneLynk's integrated system has been designed to support the needs of both the accounting and project management teams. For the accounting team, the system automates the recording of project-related transactions. For the project teams responsible for delivering projects, the system automates the project estimating, planning, control, and reporting functions needed by project managers to successfully manage projects. The diagram below describes the transaction processing model.

OneLynk incorporates end-to-end workflows and document management to automate the validation and processing of each of the transactions shown above. Project-related transactions can be submitted by employees and subcontractors at any time from anywhere. During data entry, any required documents are attached, and all transactions are assigned an appropriate charge code. Once completed, each transaction is routed for approval and processing based on the organization's approval policies. The charge code information allows the transaction to be validated and approved which updates the PL and GL.

Project Ledger

The PL allows the project accounting system to process each transaction and generate the fully burdened cost in "near-real" time. This allows an early analysis of job costs using bid and/or target indirect rates before the close of the accounting period. An integrated project accounting system allows the project management team to create project plans that includes defining the work breakdown structure (WBS), establishing project budgets, and assigning resources. Once the project plan is approved, the accounting team must assign charge codes that will be used to capture all the project-related costs. After charge codes have been assigned, the project team can begin to enter transactions. Once the transactions are approved, the integrated system will process each transaction by recording the cost and applying the indirect cost using both BID and TARGET indirect rates. This segregated cost is recorded in the PL. The PL is updated with the ACTUAL and FORECAST segregated cost after the accounting period is closed.

General Ledger

The GL is a critical component used to support the organization's accounting cycle. Each account defined in the Chart of Accounts represents a GL ledger account. The ledger accounts are used to record the financial impact of all transactions including those that are project related. The design of OneLynk's GL follows the Federal Acquisition Regulations (FAR) incurred cost submission, or "ICE Model", which is a universal requirement for all federal government contractor businesses holding cost-type or time and materials contracts, regardless of agency customer. Its function is to determine the final indirect cost rates that a contractor incurred during the fiscal year. The FAR "Allowable Cost & Payment Clause" and the "T&M Payment Clause" will be included in applicable contracts. The ICE model defines requirements for separating ALLOWABLE (direct, indirect) and UNALLOWABLE expenses and will be a key factor in how the COA is structured.

OneLynk's integrated accounting system has been designed to collect and organize the contract and project-related data required to produce accurate and timely job cost reports and to complete the incurred cost submission reports. A complete summary of OneLynk's capabilities is described in the chart below:

| Core Project Cost Accounting Capabilities | Description |

|---|---|

| Project Estimating | |

| Use of WBS templates (tasks, labor categories, materials) | Use estimating module to create re-usable estimates (WBS, staffing plan with labor categories, and bill of materials). Estimates can be used to provide quotes or create projects. |

| Integrated with the contract management system | Utilize labor categories and contract specific indirect rates when creating re-usable estimates. |

| Project Planning | |

| Build work breakdown structure (WBS) | Use project planning module to build project plan. Use either an existing estimate or create a bottom-up or top-down plan by creating the WBS, assigning resources, and assigning materials. |

| Build bill of materials and vendor selections | Submit purchase requisition, approve req, send to vendor for quote, create vendor purchase orders. Receive or return materials. All material purchases are done using a vendor PO. |

| Build staffing plan and assign resources | Use project planning module to assign project resources (employee, consultant, subcontractor). System uses the resource record to compute labor cost and budget. |

| Assign and manage charge codes to track task activities | Allow project team to define the tasks needed to manage the project. The accounting team assigned the charge codes that determine how project-related transaction cost will be recorded in the GL. |

| Maintain project cost and schedule baselines | Ability to track cost and schedule baseline for initial plan and |

| Integrated workflow for automated project plan approvals | Submit project plan with appropriate supporting document for management approval. Establish a project control team of resources who create and review estimates and plans. Send to customer for review and concurrence. |

| Integrated with item catalog to support purchasing materials | Maintain list of authorized items that can be used when creating purchase requisitions. Only authorized items and vendors can be used when creating POs. |

| Manage supporting contract and project documentation | Ability to attach any supporting document associated with the contract and project that can be accessed based on detailed access privileges. |

| Support for all government contract types | Support the management of labor hour, time & expense, fixed price and cost reimbursable contract types. |

| Project Control and Reporting | |

| Automated tracking of change orders and mods | Ability to track each contract/project mode as well as the funding associated with each change order. |

| Automated tracking of labor cost using timesheets | Employee, PM and timesheet admin approves timesheet and systems generated fully burdened cost and updates the project ledger (PL) and the general ledger (GL). |

| Automated tracking of expenses using expense reports | Use expense report module users submit expense reports, PM and AP approves expense reports and systems generates fully burdened cost and updates PL and GL. |

| Automated tracking of materials using Purchase Reqs/POs | Submit purchase requisition, approve req and create vendor purchase orders. Authorize vendor LCATs and hours using POs. All service purchases are done using a vendor PO. |

| Authorizing project resources (employees & subs) | Use work authorization to allow users to charge and assign hours and durations. Enable charge codes on the timesheets. PM receive prompts from the system regarding user's authorized limits (hours & duration). |

| Integrated workflow approvals (time, expense & purchases) | Use workflow policies to automate the approval of timesheets, expense reports, purchase requisitions and vendor invoices. |

| Billing System Integration (generation of customer invoices) | Use AR/Billing System to automate the creation of the customer invoice using data in the project ledger. The Billing Systems automatically validates hours, funded ceiling, and LCAT ceiling against contract/project data. Submit invoice for management approval, update project ledger and GL. |

| Project Ledger Integration (posting of all direct cost) | Approve timesheets, expense reports and vendor invoices are processed, and system will automatically compute and record actual indirect rates and calculate burdened cost. |

| General Ledger Integration (JEs for project transactions) | After transaction approval generate the journal entries and allows project cost to be posted to the GL. |

| Generate project job cost reports using actual & target rates | Using data in the PL, generate burdened job cost using actual & target |

| Generate project job cost reports using bid & forecast rates | Using data in the PL, generate burdened job cost using bid & forecast |

| Generate contract profit/loss summary drill down reports | Using data in the PL, generate project P/L summary at any time showing revenue, direct cost and indirect i.e., segregated cost. Generate variance analysis for cost using bid, target and forecast compared to actual indirect rates. |

| Project Closeout | |

| Generate reports for the Incurred Cost Submission | Using data in the PL and GL generate the reports defined in the ICE Model |

Ten benefits of an Integrated Project and Accounting Systems

If your organization has implemented a standalone project planning tool such as Microsoft Project or a standalone accounting system such as QuickBooks consider the benefits of implementing an integrated project accounting system, including:

- Ability to produce "near-real" time profit/loss statements for all government contract types

- The ability of project teams to create a detailed WBS required to manage the grant or contract

- Eliminates the need for manual spreadsheets to track project-related transaction costs, such as labor, travel, training, or material purchases

- Eliminates the need for manually calculating fully burdened and segregated cost

- Enables more accurate and timely customer billing and supporting documentation

- Eliminates costly re-work due to posting cost to the wrong grant or project

- Ability to view project costs using BID, ACTUAL, TARGET & FORECAST rates

- Ability to control employees' and subs' authorization of charge codes which eliminates overruns

- Ability to quickly generate the Incurred Cost Submission report

- Ability to view project cost data using actuals and commitments

- Ability to support cost-reimbursable contracts and grants

- Simplifies user support by having only one single provider to go to for resolving problems or requesting help

Learn More About AtWork Systems

AtWorkSystems' OneLynk platform, provides an integrated suite of tools you'll need to address the accounting and project management requirements for managing government grants and contracts. As the GovCon industry's most DCAA compliant ERP system, OneLynk, was built from the ground up to support project accounting and the ICE Model. OneLynk provides information that contractors need to prepare accurate and timely job cost reports as well as the incurred cost submissions (ICS). The integrated project and general ledger generate the list of required schedules for the ICS using data directly from the accounting system. Both the general ledger and project ledger have been optimized to support the project accounting and the ICS submission.

Other posts you might be interested in

View All Posts

12 min read

| October 15, 2025

AtWork & Paychex: Simplifying Business Operations Together

Read More

5 min read

| August 5, 2025

Now Is the Time to Replace QuickBooks, Unanet, and Deltek

Read More

4 min read

| August 4, 2025