- Solutions

- Partners

- Resources

- Blog

- GovCon Source

- GovCon Source Home

- Lean & Agile in the Age of DOGE

- Service Contract Act (SCA)

- DCAA Compliant Accounting

- GovCon Outsourcing & Managed Services

- Government ERP Systems

- Veteran-Owned Small Businesses

- GovCon CyberSecurity

- Graduating 8(a) Program

- SBIRs & Grants

- GovCon Growth Strategies

- GovCon Compliance Audits

- Webinars

- DCAA Compliance

- GovCon Accounting

- Graduating 8(a) Program

- Service Contract Act (SCA)

- GovCon Managed Services

- Government ERP Systems

- GovCon Reviews & Audits

- Cybersecurity Compliance

- Government Grants & Contracts

- Company

Self-Assessment Checklist

Answer a few questions to see if you are correctly and efficiently handling your Indirect Rates.

Page Summary

Page Summary

Understanding and optimizing competitive indirect rates is crucial for government contractors, as it ensures financial success, compliance with regulations, and the ability to win and manage cost-type contracts effectively. Indirect rates are vital for supporting pricing, billing, and audit requirements, even if you initially have only one government contract.

Why Do You Need Indirect Rates

Government contractors (GovCons) need competitive indirect rates to win new contracts. So, understanding indirect rates must become a fact of life for firms having or seeking government funding. Financial success in this environment depends on avoiding regulatory and administrative traps along with optimizing your competitive position.

Winning and managing cost-type contracts requires you to disclose to the government how your indirect rates were calculated. This requires setting up a DCAA-compliant accounting system that can be used to support forward pricing, provisional billing, and final rates for contract closeout. A compliant accounting system needs to track all the organization's costs and allow costs to be separated by what is allowable (direct and indirect), and what is unallowable. Your accounting system must also help produce timely and accurate job cost reports that demonstrate that your indirect cost allocation methodology is fair and equitable and can withstand the scrutiny of a government audit.

If you're just entering the government contracting market and have received your first contract or grant you may find the distinction between direct costs and indirect costs frivolous since all costs are supporting a single contract or grant. That is a correct observation until you receive another award or land a non-governmental source of revenue. Firms having a single government award are an exception and as you'll discover by reading this blog, it's a poor excuse to ignore the concept of indirect rates.

In Part 1 of this blog, we will describe how your accounting system needs to be set up to meet DCAA requirements, and how a properly configured chart of accounts allows indirect rates to be calculated quickly. In Part 2, we'll explain how indirect rates are applied to calculate the fully burdened cost and why successfully managing cost-type contracts requires calculating fully burdened cost using four sets of indirect rates. As your company grows it must rely on your accounting system to successfully manage multiple grants and contracts. The accounting system must provide the ability to view your project cost using both planned and actual costs. And because things don't always go according to plan, we'll explain why your accounting system should allow job cost reports to be generated using bid, target, actual, and forecast indirect rates.

Setting up a DCAA Compliant Accounting System

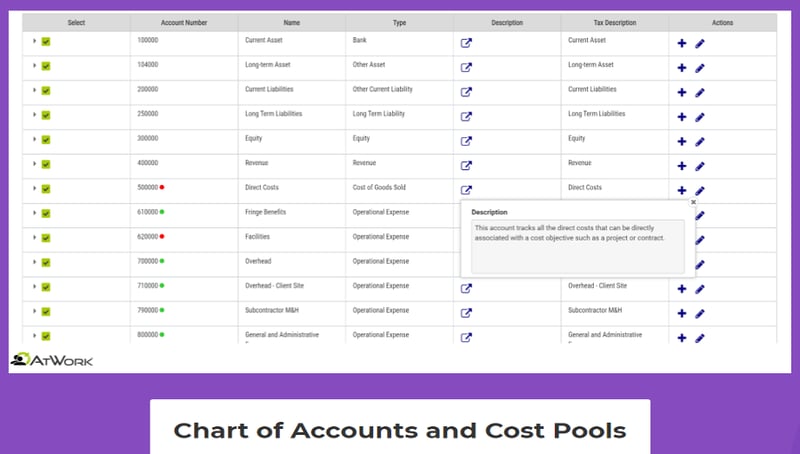

Your chart of accounts (COA) is the list of accounts used to record your business's financial activity. The COA structure provides the foundation for your indirect rate calculations. A critical step for setting up a DCAA-compliant system is to properly segregate direct, indirect, and unallowable costs. A well-structured COA allows accounts to be grouped to allow cost to flow into the cost pools that accumulate your direct, indirect, and unallowable costs.

Unfortunately, many of the commercially available accounting systems, such as products from QuickBooks or Sage Software, do not have a standard COA that supports government accounting and require additional work to be set up. Accounting systems built for government accounting, such as OneLynk from AtWork Systems provide a list of pre-configured COAs, called rate models. Each rate model provides a list of accounts and cost pools that provides a DCAA-compliant configuration that supports accurate rate calculations.

If set up correctly, your COA will facilitate the calculation of indirect rates. As the COA below illustrates, the Direct, Fringe, Overhead, G&A, and Unallowable costs are all captured using a series of sub-accounts that can be rolled up to calculate the cost pool balance needed to calculate indirect rates.

Separating Direct, Indirect, and Unallowable Costs

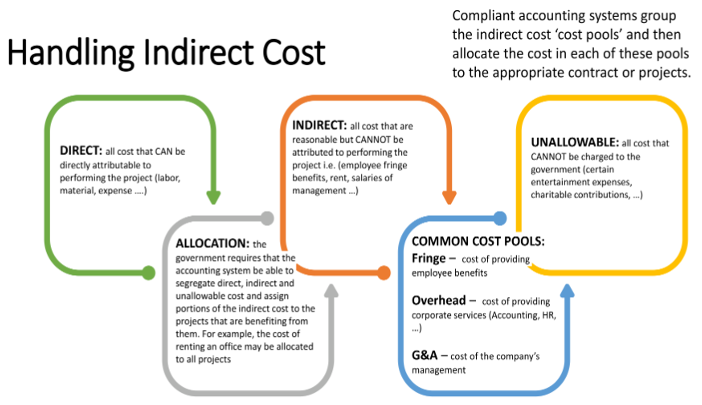

Direct costs come from expenses that are related to performing work on a specific grant or contract. Indirect costs come from expenses that relate to the overall business, which aren't incrementally caused by a specific grant or contract. These costs indirectly benefit all grants and contracts and need to be proportionally allocated, charged, and paid for by all ... government and commercial. The government's logic is that if all grants and contracts benefit from an expense, for example, rent, all grants, and contracts should pay for a portion of the rent, not just the government contract.

All grants and contracts must pay for these costs via an indirect cost recovery rate. Your indirect cost recovery rate methodology is what you believe to be the fairest and most equitable way to proportionally charge these costs to all your customers on an ongoing basis. Once per year, the government requires you to prepare an incurred cost submission or "true-up" report, which reconciles monthly indirect cost rate charges with actual indirect expenses.

The chart below summarizes what is needed when setting up a DCAA-compliant accounting system to handle each cost category.

Typical direct costs, like materials, equipment, and labor are used exclusively for one contract. Costs that are incurred to support multiple contracts and therefore aren't attributable to a single contract are classified as indirect costs. Examples of indirect costs include the salaries and benefits of the accounting and HR teams, as well as of the executive management team. Here's a quick summary of each cost category:

- Direct: includes all costs for good or services that CAN be directly attributable to performing one government or commercial contract/project, these include:

- Direct Labor (employees, consultants, and subcontractors)

- Direct Non-Labor (materials, travel, training, or other services and supplies)

- Rent or Lease (if it can be associated with a specific contract)

- Indirect: includes any costs for goods or services that benefit multiple projects that are reasonable but CAN NOT be attributed to performing a single contract/project, these include:

- Rent & Utilities

- Accounting fees

- Administrative labor costs

- Telephone and internet fees

- Fringe benefits (labor cost for sick, vacation, holidays)

- Unallowable: The FAR contains a complete list of specific expenses that are unallowable. These expenses will not be reimbursed by the government as they do not derive benefit from them, examples of these include:

- Alcohol

- Donations

- Federal income taxes

- Fines, penalties, and late fees

- First class travel (and any cost in excess of per diems)

Setting up the Right Cost Pools

Another task you'll need to complete when setting up a DCAA-compliant accounting system is determining how your indirect expenses will be allocated to your direct projects. You want to configure your accounting system so that it can calculate an indirect cost recovery rate. Accounting systems that were designed to support government contracting support establishing cost pools that facilitate calculating the indirect cost recovery rates. When selecting an accounting system, you want to make sure that the system includes the functionality to configure cost pools. Accounting systems such as QuickBooks require you to do this step manually or use a bolt-on solution.

Federal Acquisition Regulation (FAR) Part 31 provides standardized guidance for contractors to properly accumulate costs in the correct pool. Based on FAR guidance, all companies should have the same types of costs in the same pool to make rate calculations.

A common way to organize indirect cost pools is by separating fringe, overhead, and general and administrative (G&A) expenses. Typically, small and midsize businesses often choose a single fringe, overhead, and G&A structure, while larger companies typically utilize multiple fringe, overhead, and a single G&A setup.

Fringe

Fringe costs typically include employee-related expenses, such as:

- Payroll taxes

- Health insurance

- Retirement plans

- Tuition assistance

- Paid time off

These benefits are a form of payment for services beyond the direct compensation paid to employees.

Overhead

Overhead costs are those incurred through support operations or the direct production of goods or services but aren't attributable to any single contract or project. One example is your company's operations management, provided that it functions to support your overall operations. While overhead costs are directly tied to project execution, they can't be allocated to any single contract because they support multiple projects. They include costs like:

- Salaries of program managers who oversee several contracts

- Indirect expenses for the direct labor personnel

- IT, security, and facilities costs where direct employees work

Overhead includes the depreciation of any equipment that your company uses across projects, quality assurance, and other costs like indirect labor and training.

General and Administrative (G&A)

G&A expenses are incurred in support of an entire organization. These are costs resulting from the general operation of your business. They're not attributable to any one contract or project because their functions benefit your entire company. Examples of G&A expenses include:

- General liability insurance

- Legal costs

- Accounting and finance

- Licenses and dues

- Executive salaries

- Business development

- Marketing and sales

G&A costs are often allocated over a total cost input base or a value-added base.

Allocation Base

Let's talk a bit more about allocation bases as they relate to your DCAA-compliant indirect rate calculation. The government requires you to implement a reasonable system that assigns a portion of the indirect cost to the contracts or projects that are benefiting from them. For example, the cost of renting an office may be allocated to all contracts or projects. Your accountant will develop an allocation base and use it to assign the cost to each contract or project. Typically, the government will review and approve how you plan to allocate your indirect cost.

All projects must pay for these costs via an indirect cost recovery rate. Your indirect cost recovery rate methodology is what you believe to be the fairest and most equitable way to proportionally charge indirect costs to all your customers on an ongoing basis. The accounting system's cost pools group the indirect cost into buckets, the balance in the cost pool makes up the numerator (A) and the allocation base balance makes up the denominator (B) when determining the indirect cost recovery rate. The rate is calculated by dividing A by B. This allows the cost in each of these pools to be allocated appropriately to each project.

The indirect rate is calculated by taking the cost pool balance and dividing it by the allocation base. This calculation shows you how much of your indirect costs each unit of the allocation base must cover. What you'll need to do before making this calculation is organize your various indirect costs into pools.

A common COA structure used when a government contractor has no complications in the incurrence of indirect costs that require multiple overhead or general and administrative (G&A) pools is to use a single fringe, overhead and G&A rate. It is easy for the contractor to administer, and easy for the contracting officers to understand. It provides three indirect rates - one for each cost pool. In this model, Direct Costs and Unallowable Costs flow through to their final cost objectives. The Fringe, Overhead, and G&A rates are created by dividing the sum of the Pool Components by the sum of the Base Components defined for each rate.

Preparing Annual Operating Budget (Planned versus Actual Cost)

Well-run government contractors prepare an annual operating budget and use it to develop target indirect rates. The budget serves as a benchmark of the expenses that the contractor plans to incur. The target rates are calculated using the annual budget and the corresponding pools and bases. Throughout the year business transactions are recorded, processed, and posted using the accounting system. The cost associated with these transactions is used to compute actual rates. Comparing target rates to actual rates provides a means for the business to constantly monitor their internal controls and financial performance. The objective is to ensure there is no variance between target and actual rates. if a significant variance exists, it must be analyzed and addressed.

Calculating Fringe Indirect Rate

You see that the fringe cost pool is made up of the total in all the fringe benefit accounts. This makes up the (A) part of the formula. The allocation base is made up of the total of all the labor accounts. This includes both the direct and indirect labor accounts. This makes up the (B) part of the formula.

|

Fringe Pool (A) |

Fringe Allocation Base (B) |

|

|

610000 Fringe Benefits |

500000 Direct Labor |

|

|

611000 Vacation |

+ 510000 Overhead Labor |

|

|

611500 Holidays |

+ 520000 G&A Labor |

|

|

612000 Sick Leave |

+ 520050 IR&D/B&P Labor |

|

|

612500 Payroll Taxes |

||

|

613000 401(k) Plan |

||

|

614000 Group Insurance |

||

|

Fringe Pool (A) / Fringe Allocation Base (B) = Fringe Rate |

||

Fringe costs are accumulated into only one indirect cost pool and are allocated based on total worked labor. Fringe costs essentially are the costs associated with having employees: payroll taxes and employee benefits. Because these costs are allocated based on total worked labor, the fringe applied to direct labor will be allocated to final cost objectives, while the fringe applied to indirect labor will be allocated to their respective indirect cost pools, to then be reallocated on whatever basis the costs of those pools are distributed. Consequently, fringe applied to overhead labor will be allocated to the overhead cost pool, and fringe allocated to G&A labor will be allocated to the G&A cost pool.

Calculating the Overhead Indirect Rate

You see that the overhead cost pool is made up of the total in all the overhead accounts. It also includes the fringe benefits amount applied to the overhead labor and business development (BD) labor. This makes up the (A) part of the formula. The allocation base is made up of the overhead labor account, fringe benefits applied to overhead labor, plus fringe benefits applied to bid and proposal labor. This makes up the (B) part of the formula.

|

Overhead Pool (A) |

Overhead Allocation Base (B) |

|

|

700000 Overhead |

510000 Direct Labor |

|

|

+ total of all Overhead Accounts |

+ fringe benefits applied to direct labor |

|

|

+ Fringe Benefits applied to Overhead Labor |

+ 520000 B&P Labor |

|

|

+ Fringe Benefits applied to BD Labor |

+ fringe benefits applied to B&P labor |

|

|

Overhead Pool (A) / Overhead Allocation Base (B) = Overhead Rate |

||

Calculating the G&A Indirect Rate

You see that the G &A cost pool is made up of the total in all the G & A accounts, the fringe benefits applied to G&A labor, the fringe benefits applied to B&P labor, and the overhead applied to B&P labor, plus fringe. This makes up the (A) part of the formula. The allocation base is made up of all direct costs, the fringe benefits applied to direct labor, the overhead applied to direct labor and the total of all the unallowable accounts. This makes up the (B) part of the formula.

|

G&A Pool (A) |

G&A Allocation Base (B) |

|

|

800000 General & Admin |

500000 Direct Costs |

|

|

+ total of all G&A accounts |

+ fringe benefits applied to direct labor |

|

|

+ fringe benefits applied to G&A labor |

+ overhead applied to direct labor |

|

|

+ fringe benefits applied to B&P labor |

+ total of all unallowable expense accounts |

|

|

+ overhead applied to B&P labor + fringe |

||

|

G&A Pool (A) / G&A Allocation Base (B) = G&A Rate |

||

Indirect Cost Reporting

For auditing purposes, GovCon contractors must properly calculate their indirect rates and back up their calculations with all necessary documentation. By making your company's indirect rate calculation a routine part of its operations, you'll have a much easier time verifying the results with DCAA and paving the way for a much smoother bidding and auditing process. Having technology that automates such calculations is vital, so you'll want your accounting system to handle this without a lot of manual intervention.

Learn More About AtWork Systems

AtWork Systems' OneLynk platform, provides an integrated suite of tools you'll need to address the accounting and project management requirements for managing government grants and contracts. The GovCon industry's most DCAA compliant ERP system, OneLynk, was built from the ground up to support project accounting and the ICE Model. OneLynk provides information that contractors need to prepare accurate and timely job cost reports as well as the incurred cost submissions (ICS). The integrated project and general ledger generate the list of required schedules for the ICS using data directly from the accounting system. Both the general ledger and project ledger have been optimized to support the project accounting and the ICS submission.

Other posts you might be interested in

View All Posts

12 min read

| October 15, 2025

AtWork & Paychex: Simplifying Business Operations Together

Read More

5 min read

| August 5, 2025

Now Is the Time to Replace QuickBooks, Unanet, and Deltek

Read More

4 min read

| August 4, 2025