- Solutions

- Partners

- Resources

- Blog

- GovCon Source

- GovCon Source Home

- Lean & Agile in the Age of DOGE

- Service Contract Act (SCA)

- DCAA Compliant Accounting

- GovCon Outsourcing & Managed Services

- Government ERP Systems

- Veteran-Owned Small Businesses

- GovCon CyberSecurity

- Graduating 8(a) Program

- SBIRs & Grants

- GovCon Growth Strategies

- GovCon Compliance Audits

- Webinars

- DCAA Compliance

- GovCon Accounting

- Graduating 8(a) Program

- Service Contract Act (SCA)

- GovCon Managed Services

- Government ERP Systems

- GovCon Reviews & Audits

- Cybersecurity Compliance

- Government Grants & Contracts

- Company

January 10, 2023

How to Successfully Graduate from the SBA 8(a) Program - Part 2

Written by: Ron Lewis

Page Summary

Page Summary

Understand the journey of 8(a) firms in government contracting, emphasizing the need to develop various corporate capabilities and leverage technology to succeed in competitive pricing and contract acquisition. Graduating from the 8(a) program requires strategic planning and investment in the right infrastructure.

Part 2 - Building Capabilities Required for Success

In Part 1 - A Framework for Success, we described a framework for successfully exiting the SBA (Small Business Administration) 8(a) Business Development program. In the second part of this blog series, we'll focus on building the capabilities required to implement a successful exit. We focus on the capabilities journey and describe how to build the required capabilities that need to be in place before graduating. A key objective is to build these capabilities by reducing the reliance on manual processes.

AtWork Business Managed Services for Government Contractors

OneLynk provides the processes to achieve government compliance while offering subject matter experts

across functions like accounting, HR, finance, contract and project management.

across functions like accounting, HR, finance, contract and project management.

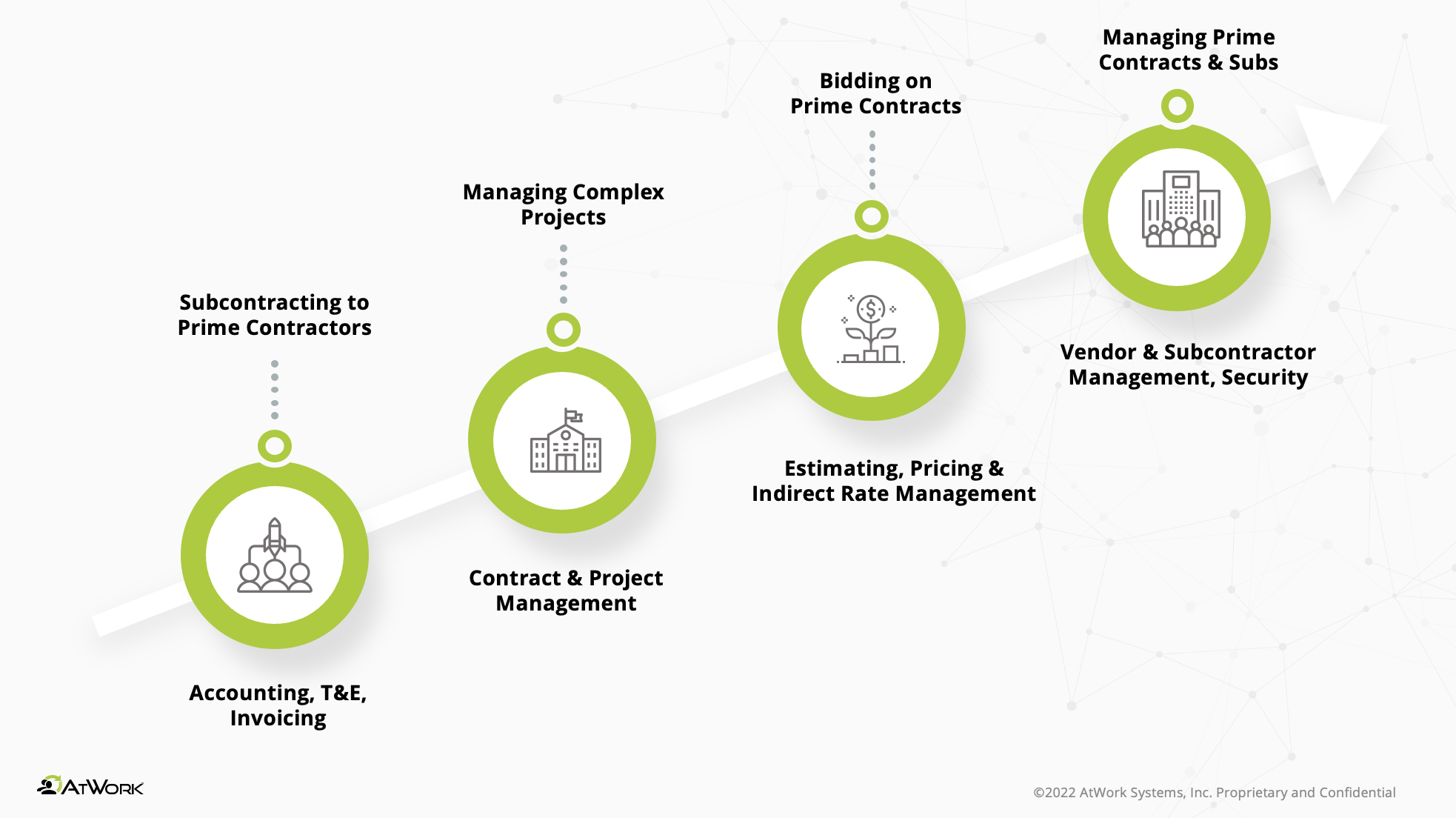

An 8(a) Firm's Capability Journey

A range of corporate capabilities will be needed to implement a successful exit strategy from the SBA 8(a) program. Building your company's capabilities in a way that you can stay lean and have competitive indirect rates starts when you enter the 8(a) program. We'll take a closer look at the 8(a)-capability journey while re-iterating the need to leverage technology to eliminate manual processes. In Part 3 - Building Competitive indirect Rates, we focus on the impact building lean capabilities has on competitive pricing. Most Government Contracting firms (GovCons) have a proposal win rate of about 30% if you can increase your win rate to this level it will significantly increase your chances of successfully graduating. Bidding and winning are the key success factor to survival. You need to build a solid plan for growing the capabilities, described below.

Like all successful government contractors, 8(a) firms face three significant challenges when growing their business: (1) investing to build the corporate capabilities needed to consistently deliver (2) understanding what it takes to win new contracts in your market segment, and (3) controlling the growth of indirect cost. Graduating from the 8(a) Program will create a greater sense of urgency to address these challenges. Improving the ability to deliver and win requires thoughtful investment in the right "back-office" infrastructure (processes and systems) that underpin required capabilities. Developing and executing a strategy starts years before graduating.

By the time you graduate, you should have built the range of capabilities required to become a prime contractor. Realize that this cannot be done overnight, it's a journey that requires a plan. The capabilities journey often starts with successfully delivering staff augmentation services and concludes with establishing the full range of capabilities required to become a prime contractor. For most GovCons, a decision to implement an ERP system is a critical milestone because it puts in place the required capabilities while introducing the change management required to mature the organization's operating model.

The diagram illustrates the capabilities journey for a typical GovCon and the challenges to establishing a mature operating model. In this blog, we explain how the selection of an ERP system that delivers the capabilities "just-in-time" when they are needed addresses these challenges. Selecting the right ERP establishes the foundation required to stay lean which controls indirect costs.

To succeed you will have to develop your niche, you will have to develop your quality, you will have to deliver a competitive price and you will have to show that you can handle cost-reimbursable contracts.

As the diagram illustrates, there is a considerable effort that must be properly orchestrated to be a successful Government contractor. You must grow and mature your capabilities as needed through appropriate just in time technology investments and processes

When you start as a government contractor, you'll need basic (accounting, HR, T&E, and invoicing). As you take on more complex contracts/projects you'll need more advanced contract/project management capabilities because the government will be asking for much more data regarding contract and project status. Bidding on contracts requires estimating, pricing, and managing indirect rates. Becoming a prime contractor also requires vendor and subcontractor management. As you grow your capabilities to bid on full and open competitions, you'll need to focus on implementing compliant systems in the following areas:

Accounting

There are a set of rules and guidelines you'll need to follow when managing government grants and contracts. And the government's DCAA will conduct audits to determine your compliance. However, there is no such thing as a DCAA-approved government accounting system off the shelf. An accounting system is more than just a software package. It includes accounting methods, procedures, and controls. Many accounting software applications can be part of an acceptable accounting system or set up in a manner that fails to meet the requirements of an acceptable system. To be acceptable, your accounting system needs to track all the organization's costs and allows you to separate your cost by what is allowable (direct and indirect), and what is unallowable. Your accounting system must help you demonstrate that your indirect cost allocation methodology is fair and equitable and can withstand the scrutiny of a government audit.

Contractors cannot request the audit. DCAA does not perform audits requested by a contractor. DCAA only performs these audits based on a request from a federal entity that is responsible for determining the acceptability of a contractor's system.

Timekeeping

Labor costs are often the largest expense for most government contracts. This is not lost on the government. The government mandates that every employee in your organization assigned to work on a government contract, either directly or indirectly, must maintain a timesheet. These timesheets must include all the active projects employees are working on, both government and commercial. The timesheet must also allow them to record indirect labor such as vacation, holidays, sick and administrative time.

It is also a FAR requirement for your organization to put in place the following timekeeping policy:

- Employees must complete their timesheets daily.

- If using paper-based timesheets, they must be prepared in ink.

- Employees must record all time spent (even if more than 40 hours/week).

- The employee must sign off on the timesheets and must get their supervisor's approval.

- Any corrections must be handled as follows ... do not erase anything, draw a line through any errors and write in the correct information, and initial and date the corrections.

- If using electronic timekeeping, the system must be able to maintain an audit trail of the corrections.

Your timekeeping system can be either paper-based or electronic. The government doesn't make blanket approvals for commercially available electronic timekeeping systems. However, to be considered acceptable by a government auditor, an electronic system must provide a date-stamped audit log for all data entry including changes and approvals ... this creates an audit trail.

Expense Reporting

When contracts contain dollars for direct expenses you must maintain an expense reporting system. If the expense involves travel the system must follow the rules defined in the joint travel regulation (JTAR) regarding the per diem rates. The expense reporting system must ensure that any travel that exceeds the per diems is identified as unallowable. Expense Reports should be submitted by the employees for their business trips to receive reimbursement for expenses that occurred for business travel. The government requires the original receipt(s) for all expenses for verification. Without the original receipt, the expenses cannot be reimbursed. Incorrect expenses are the number one adjustment in DCAA audits.

Estimating

The estimating system should provide for the use of appropriate source data, utilize sound estimating techniques and good judgment, maintain a consistent approach, and adhere to established policies and procedures. Here is a short summary of a few of the most important requirements for an acceptable estimating system:

- Establish clear responsibility for the preparation, review, and approval of cost estimates and budgets.

- Identify and document the sources of data and the estimating methods and rationale used in developing cost estimates and budgets.

- When practicable, provide procedures that ensure subcontract prices are reasonable based on a documented review and analysis provided with the prime proposal.

- Provide estimating and budgeting practices that consistently generate sound proposals that are compliant with the provisions of the solicitation and are adequate to serve as a basis to reach a fair and reasonable price.

- Have an adequate system description, including policies, procedures, and estimating and budgeting practices, that comply with the Federal Acquisition Regulation and Defense Federal Acquisition Regulation Supplement.

A complete list of requirements can be found at Cost Estimating System Requirements.

Purchasing

If you have at least one prime contract containing FAR clause 52.244-2 which reserves the government's right to review your purchasing system, the system may be subject to a review. The Contractor Purchasing System Review (CPSR) Guide provides a comprehensive reference for the requirements for a compliant purchasing system. The CPSR is performed by the Defense Contract Management Agency (DCMA) to evaluate the efficiency and effectiveness with which a contractor spends Government funds and complies with applicable contract terms, regulations, and government policy when subcontracting. The review provides Contracting Officers (COs) with a basis for granting, withholding, or withdrawing approval of the contractor's purchasing system.

A contractor is eligible for a CPSR when sales to the Government are expected to exceed $50 million during the next 12 months excluding competitively awarded firm-fixed-price contracts awarded with or without an economic price adjustment and sales of commercial items. The CO may determine the need for a CPSR based on, the contractor's past performance, as well as the volume, complexity, and dollar value of subcontracts.

A complete list of CPSR requirements can be found in CPSR Guidebook.

Property Management

If your business involves utilizing government-furnished equipment, then you must follow the requirements described in the FAR for how this equipment must be managed. In Far Part 45, the government policy prescribes policies and procedures for providing Government property to contractors. FAR 52.245-1 prescribes that the contractor shall have a system of internal controls to manage (control, use, preserve, protect, repair, and maintain) Government property in its possession.

The system must allow Government-furnished equipment to be tagged, labeled, or marked based on DoD marking standards (MIL Standard 130), or other standards when the requiring agency determines that such items are subject to serialized item management.

Conclusion

Overall, the process can seem daunting, but with the right team, and an early start (5 years or more 'til graduation), your organization can mitigate or eliminate most of the risks and set you up for long-term success.

In Part 3 - Building Competitive Indirect Rates, we focus on building the core capabilities you'll need to successfully compete and win full and open competitions.

Other posts you might be interested in

View All Posts

OneLynk

12 min read

| January 3, 2023

How to Successfully Graduate from the SBA 8(a) Program - Part 1

Read More

CyberPlan

11 min read

| November 23, 2022

How to Get CMMC Pre-Certified

Read More

OneLynk

10 min read

| January 16, 2023